Call: 214.PLANNER (752.6637)

Small Business Owners – Business Growth & Expansion Financial Concepts and Strategies

BABY

BOOMER

& SENIOR

CITIZEN

EMPLOYEES

IMMEDIATE

SELF

FUNDED

RETIREMENT

PLANS

Click on Links . . .

CALL: 214.PLANNER (752.6637)

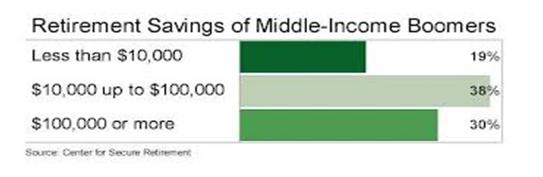

AVERAGE VALUE OF ALL BABY BOOMERS 401K RETIREMENT SAVINGS IS $80,000

OVER 40,000,000 BABY BOOMERS HAVE LESS THAN $80,000 SAVED FOR RETIREMENT

CALL: 214.PLANNER (752.6637)

Retirement Plan

$325,000 Maximum Reverse Mortgage To Pay Off An Existing Mortgage Loan Balance

The approximate maximum Reverse Mortgage Loan of $325,000 will allow Employees in the

Workplace who are Baby Boomer Senior Citizens, use Reverse Mortgage Factoring with their

Financial Planner and Retirement Planner, to calculate if the Reverse Mortgage is a useful

Retirement Planning Tool to Pay-Off their Existing Mortgage Loan, that will allow the

62 Year Old Plus Baby Boomer to be able to Retire.

Workplace who are Baby Boomer Senior Citizens, use Reverse Mortgage Factoring with their

Financial Planner and Retirement Planner, to calculate if the Reverse Mortgage is a useful

Retirement Planning Tool to Pay-Off their Existing Mortgage Loan, that will allow the

62 Year Old Plus Baby Boomer to be able to Retire.

NOW

WE

CAN

RETIRE

WITH

A REVERSE

MORTGAGE

REVERSE

MORTGAGE

PAYS

OFF

EXISTING

MORTGAGE

TO

STOP

PAYMENTS

TO

RETIRE

HOW AND

WHEN TO

PAY

OFF A

RETIREMENT

REVERSE

MORTGAGE

LOAN?

• Fact – A Reverse Mortgage Loan does not become Due and Payable until After the Death of the

Home Owner or Surviving Spouse or Surviving Home Owner/s . . .

Home Owner or Surviving Spouse or Surviving Home Owner/s . . .

REVERSE

MORTGAGE

LOAN

PAY

OFF

AFTER

DEATH

• Traditionally Life Insurance is used to Fund an Estate to Pay the Final Expenses of an individual . . .

• Universal Life Insurance is the best type of Life Insurance Policy to Purchase to Pay Off

A Reverse Mortgage after the Death of a Home Owner of Surviving Spouse or Surviving Home Owner

• Universal Life Insurance is the best type of Life Insurance Policy to Purchase to Pay Off

A Reverse Mortgage after the Death of a Home Owner of Surviving Spouse or Surviving Home Owner

UNIVERSAL

LIFE

INSURANCE

UNIVERSAL

LIFE

INSURANCE

ESTATE

PLANNING

REVERSE

MORTGAGE

LOAN

PAY

OFF

LIFE

INSURANCE

Click On The Key Board

Click On The Key Board

Click On Key Board To Get a Free Quote For Universal Life Insurance

Senior Citizen Estate Planning Reverse Mortgage Loan Pay Off Life Insurance . . .

Senior Citizen Estate Planning Reverse Mortgage Loan Pay Off Life Insurance . . .

Employee Income Replacement

TERM

LIFE

INSURANCE

IS

THE

BEST

POLICY

EMPLOYEE

INCOME

REPLACEMENT

LIFE

INSURANCE

STRATEGIES AND

CCONCEPTS

EMPLOYEE

FAMILY

INCOME

REPLACEMENT

LIFE

INSURANCE

PROTECTION

FAMILY

BREADWINNER

INCOME

PAYCHECK

REPLACEMENT

LIFE

INSURANCE

QUOTE

Click On The Key Board

Click On The Key Board

Click On Key Board To Get a Free Quote For Term Life Insurance

CALL: 214.PLANNER (752.6637)

Small Business Owners / Partners – Retirement Planning and Business Continuation

Business Owners

Two (2) Ways To Retire

Click on Red Retirement Button

BUSINESS

CONTINUATION

CONCEPTS AND

STRATEGIES

Three (3) Core Steps to Effective Business Continuation Planning:

1) Obtain a Business Valuation

2) Structure the Agreement

3) Fund the Agreement

Buy / Sell Agreements:

A properly Drafted and Funded Buy / Sell or Business Continuation Agreements, help ensure continuity when a Principal or Partner exits the business.

A properly Drafted and Funded Buy / Sell Agreement can help to;

• Provide an orderly Transfer of Business Interest upon Death, Disability, Retirement, or

Termination by providing for Purchase of the Ownership interest at a predetermined Price.

• Help permit remaining shareholders to retain control

• Create a market for inactive shareholder shares

• Plan for Funding and Ownership Transfer

• Fix the Price and Terms of the Sale by establishing a value within an Estate

• Provide liquidity for the Family of a Deceased shareholder

1) Obtain a Business Valuation

2) Structure the Agreement

3) Fund the Agreement

Buy / Sell Agreements:

A properly Drafted and Funded Buy / Sell or Business Continuation Agreements, help ensure continuity when a Principal or Partner exits the business.

A properly Drafted and Funded Buy / Sell Agreement can help to;

• Provide an orderly Transfer of Business Interest upon Death, Disability, Retirement, or

Termination by providing for Purchase of the Ownership interest at a predetermined Price.

• Help permit remaining shareholders to retain control

• Create a market for inactive shareholder shares

• Plan for Funding and Ownership Transfer

• Fix the Price and Terms of the Sale by establishing a value within an Estate

• Provide liquidity for the Family of a Deceased shareholder